virginia state ev tax credit

For more information see the Virginia DMV Electric Vehicleswebsite. Virginia State And Federal Tax Credits For Electric Vehicles Pohanka Chevrolet.

Tax Credit For Electric Vehicle Chargers Enel X

Virginia isnt the only entity that aims to incentivize the ownership of electric models.

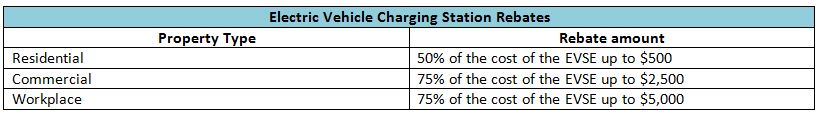

. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. Commercial customers who purchase and install EVSE can receive up to 2000 for each charger and up to four rebates per year. An additional 2000 rebate would be available.

HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate. TSD-110 Revised February 2022 WEST VIRGINIA TAX CREDITS. Drive Electric Virginia is a project of.

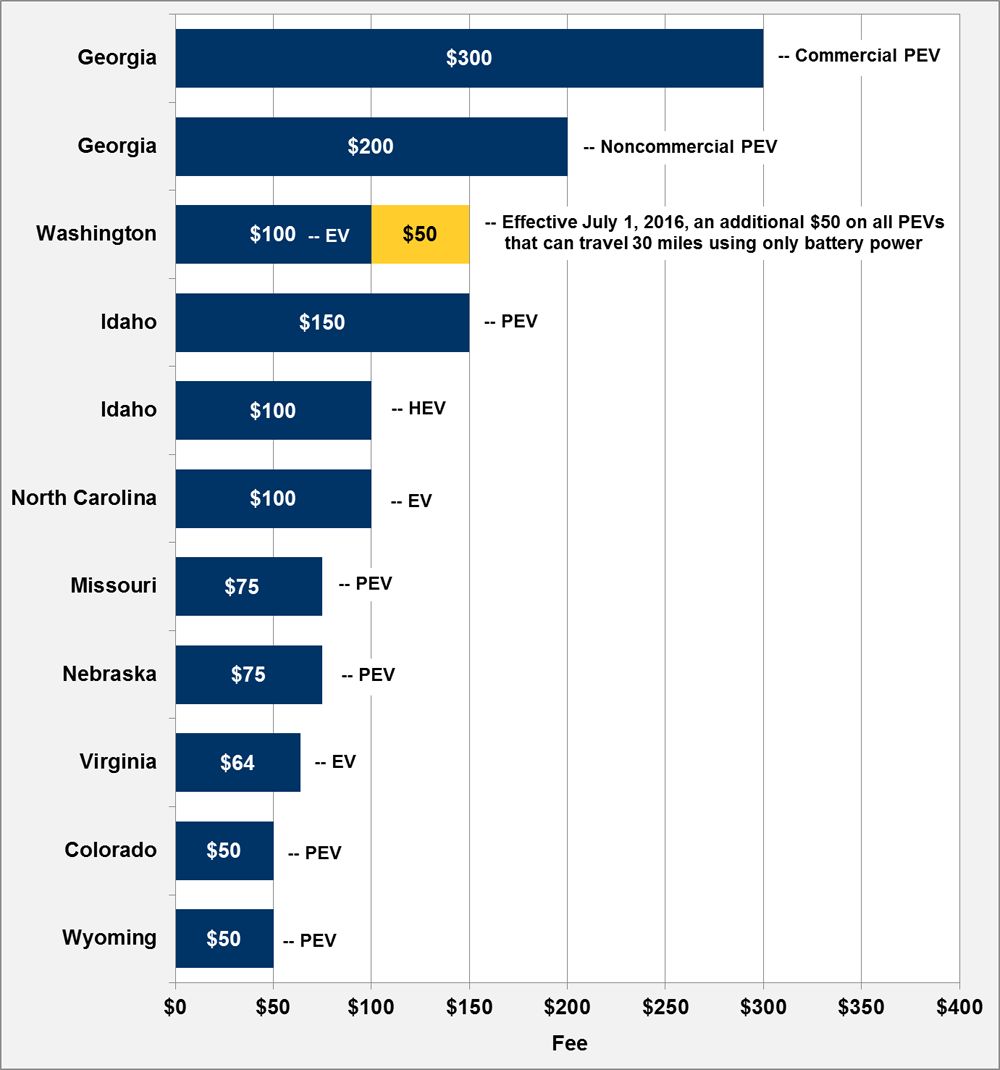

Reference Virginia Code581-2217 and 581-2249 Electric Vehicle EV Rebate Program Working Group. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. All-electric vehicles EVs registered in Virginia are subject to a 8820 annual license tax at time of registration.

The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021. Reference Virginia Code581-2217 and 581-2249 Electric Vehicle EV. Richmond EV Readiness Plan May 3 2021.

An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. Light duty passenger vehicle. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

The Virginia Department of Mines Minerals and Energy is authorized to administer a rebate program for the purchase of a new or used EV. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. The current credit offered to ev buyers is for up to 7500 usd and is set to increase if the bill passes in the senate.

You may be able to get a maximum of 7500 back on your tax return. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Consumers who purchase qualified residential charging equipment prior to December 31 2021 may receive a tax credit of 30 of the cost up to 1000.

Light duty electric truck. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. January 13 2022 If youve been shopping for or researching an electric vehicle youve almost certainly heard about things like EV tax credits specifically the federal governments offer of a.

Virginia Tax Credits In addition to the benefits provided at the federal level the Commonwealth of Virginia also offers several incentives if you own an EV. If the purchaser of an EV has an income that doesnt exceed 300 percent of the federal poverty level they can get an extra 2000 on their. Used Vehicles Would Qualify.

Heavy duty electric truck. CALeVIP Alameda County Incentive Project. There are federal programs that when you purchase a fully electric vehicle you get a 7500 tax credit so that also helping the environment greater distance and then the federal tax credit.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Federal government also has credits and perks for you to take 2. Virginias Initial Electric Vehicle.

The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle. Electric Vehicle EV Rebate Authorization.

All-electric vehicles EVs registered in Virginia are subject to a 8820 annual license tax at time of registration. Medium duty electric truck. Virginia Electric Vehicle Tax Credit 2022.

Rebates may not exceed 2500. A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate 2. Virginia entices locals to go green by offering numerous time- and money-saving green driver incentives.

Opens website in a new tab. These perks include alternative fuel vehicle AFV emissions test exemptions for electric cars and hybrids high occupancy vehicle HOV lane access for clean-fuel vehicles state and federal tax incentives discounted electric vehicle EV charging rates fuel-efficient auto. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500.

Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

Residents of Loudon and Arlington counties may qualify for a reduced personal property tax while those who charge their vehicle at home can take advantage of discounted electricity rates during off-peak hours. If you live in either Arlington or Loudoun County you may qualify for reduced personal property tax. Reid D-32nd would have granted a state-tax rebate of up to 3500.

CALeVIP Alameda County Incentive Project provides rebates to entities toward the purchase and installation of EV chargers. And it says Enhanced Rebate for Qualified Resident of the Commonwealth which is defined in the header at someone who makes less than 300 of the poverty line. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

Review the credits below to see what you may be able to deduct from the tax you owe. Virginia entices locals to go green by offering numerous time- and money-saving green driver incentives. A bill proposed in mid-January by Virginia House Delegate David A.

Virginia Tax Credits The Commonwealth of Virginia provides several incentives for drivers of EVs to take advantage of. In its final form the program which would begin Jan.

How Do Electric Car Tax Credits Work Kelley Blue Book

Latest On Tesla Ev Tax Credit March 2022

Plug In Electric Vehicle Policy Center For American Progress

Electric Vehicles Office Of Environmental And Energy Coordination

Ev Charger Rewards Virginia Dominion Energy

Rebates And Tax Credits For Electric Vehicle Charging Stations

Charging Incentives Support Growing Virginia Ev Adoption Virginia Clean Cities

Rebates And Tax Credits For Electric Vehicle Charging Stations

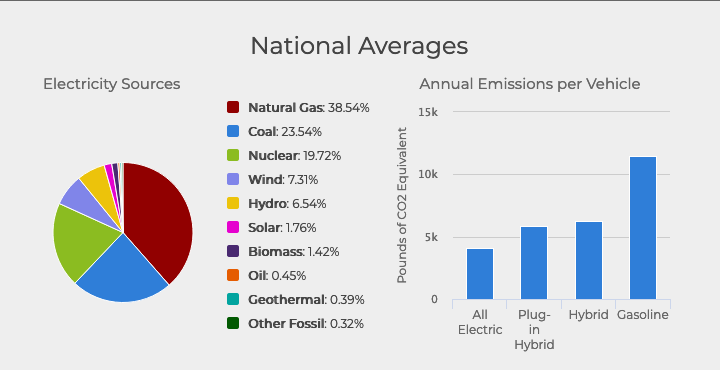

Electric Vehicles Have Lower Well To Wheel Emissions In All 50 States And Dc Than Gas Powered Vehicles Evadoption

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Are Ev Tax Credits Back On The Table Maybe E E News

Electric Car Tax Credits What S Available Energysage

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist